"Altria Reports 2021 Fourth-Quarter and Full-Year Results" $MO

Altria reported results for Q4 2021. Some highlights from the conference call:

- First, Altria grew its 2021 adjusted diluted earnings per share by 5.7% driven in part by the resiliency of our cigarette, cigar and moist smokeless tobacco businesses. Additionally, we returned more than $8.1 billion in cash to shareholders through dividends and share repurchases. This total represents the third largest single year cash return in Altria's history and the largest annual return since 2002.

- Despite year-over-year volatility due to pandemic-related factors, total tobacco volume trends remained stable. In fact, we estimate that overall tobacco space volumes have decreased by 0.3% annualized for the past two years and by 0.8% over the last five years on a compounded annual basis.

- Diving deeper, total estimated equivalized volumes for smoke-free products in the U.S. grew to 3.8 billion equivalized units in 2021 and represented approximately 24% of the total tobacco space.

- The on! nicotine pouch category reached a total oral tobacco retail share of 17.9 percentage points in the fourth quarter, growing 7.4 share points year over year. We're encouraged that on! represented more than one-third of this growth and the brand is proving to be a highly competitive product in the space. Our premarket tobacco applications for the entire on! portfolio remained pending with the FDA and we believe that the FDA should determine that the marketing of these products is appropriate for the protection of public health.

- In the second quarter of 2020, we disclosed two milestones in our IQOS agreement with PMI necessary for PM USA to maintain its exclusive license and distribution rights for IQOS in the U.S. and to earn the renewal option for an additional five-year term. The initial five-year term does not expire until April of 2024, but we believe that PM USA has already met these milestones based on the strong performance of IQOS in the Charlotte and Northern Virginia markets. PMI has communicated that it disagrees with our position. We expect to continue discussing these matters with PMI.

- We are encouraged that the FDA has authorized a product in each of the three major smoke-free categories. Going forward, this year, we expect the FDA to carefully consider the scientific merits of each remaining application and we're hopeful for significant progress in product marketing and claim authorizations.

- There -- our only participation in the e-vapor category would be through our minority investment in JUUL. And I think if you step back and see the success JUUL had in the marketplace with converting adult smokers to the e-vapor category, you'll see that it still has the lead in market share in the U.S. with adult tobacco consumers.

Altria stepped up repurchases in Q4: they bought back 15.5 million shares at an average price of $45.4, for a total cost of $703 million in Q4 2021; and bought a total of 35.7 million shares at an average price of $46.97, for a total cost of $1.7 billion in FY2021. They paid $6.4 billion of dividends in 2021, which makes for a total of $8.1 billion of dividends and share repurchases during the year.

The Altria market capitalization is $92 billion. If you subtract $10.8 billion for the value of Altria's stake in Anheuser Busch, that's an adjusted market cap of $81.2 billion for the cigarette, cigar, oral tobacco, marijuana, and reduced risk (e.g. on! and Juul) businesses. Trading for almost exactly a 10% shareholder yield, which is being paid for with cigarette profits.

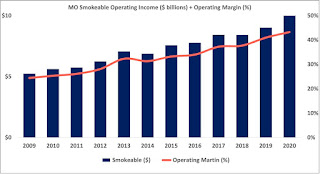

So, is Altria "dying"? Is some of that 10% shareholder yield a return of capital rather than real earnings? Is this a boomer dividend stock? Every time we check in, smokeable product volumes are down, but revenue is up and smokeable earnings are up.

It was true again in Q4: domestic cigarette shipment volume decreased 5.9%, net revenues increased 0.4%, and revenues net of excise taxes increased 2.3%. The operating income for the smokeable products segment increased 4.9% from the fourth quarter of 2020 and earned $2.5 billion.

That chart is from @PricetoWealth on Twitter. In the past when we have sold dying businesses short - something we have done quite a lot of - they have had certain elements in common. Falling revenue, low gross margins, high fixed costs, low operating margins, operating income declining faster than revenue (operating losses), high (and increasing) debt, no dividends (raising money from capital markets, not returning it), high debt yields. Altria does not match any of those criteria of dying businesses.

There is a big question with tobacco investments, and that is whether cigarette sales will ever stop declining, and whether cigarette price increases can compensate for volume declines in perpetuity. This is a question about the elasticity of demand for cigarettes. We have some reason to believe that there is a core cigarette customer that is very price insensitive. Also, Altria's price increases - mid single digit percentage increases - used to be greater than inflation, but now they are arguably less than inflation. So that should be building in a little bit of cushion to take the price of a pack higher if needed.

No comments:

Post a Comment