Followup on Magellan Midstream and the Equity Risk Premium Strategy

Last year we wrote a post about our "equity risk premium strategy," which referred to a combination of our sector rotation value strategy (looking for companies in industries that have been through an under-investment cycle) and a search for companies with equity yields significantly higher than their debt yields.

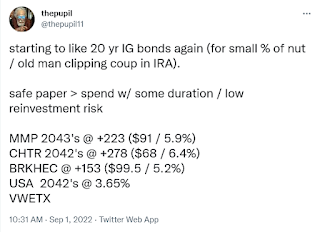

We pointed out that Magellan Midstream Partners, L.P. (MMP) had a 516 basis point spread between its dividend yield and the yield on 2050 maturity. Today, a fellow on Twitter happened to mention a Magellan bond (an earlier maturity, not the 2050) as an investment idea:

We've been asked recently about the advisability of buying CD's (now yielding in the mid 3%-range for a 5 year CD) or investment grade bonds (shown above).

Before we talk about that, let's go back and look at how Magellan bonds and equity performed since the original ERP strategy post in March of 2021. First, the units:

The unit price is up by about a third, plus there have been six quarterly dividends paid, an additional $6.205, which is a further 16% on original cost. Meanwhile, the bond that we mentioned (the 2050 maturity) has sustained a significant capital loss because of higher interest rates:

The yield on this bond went from 4% to 5.6%, and since it is long duration, the bond fell in price from nearly par to 77 cents, about a 20 percent loss. In the year in a half since the post, that loss has been offset somewhat by 5.9 points of coupon interest income. Still, a 14% mark-to-market decline represents a loss of three-and-a-half years' of coupons.

Something else interesting about this bond price decline is that when we talk about the enterprise value of Magellan, we use the market value of equity (market capitalization) and the face value of the debt. However, we could adjust the enterprise value to use the market value of the debt, too, and as you see on the lengthier maturities it would be quite a haircut. The bondholders' loss is the unitholders' gain.

So, the right trade when MMP bonds were yielding 4% and the units were yielding 9% (the 5% spread mentioned earlier) was to buy the stock and not the bonds.

What about now? The dividend yield on the units is 8% and the bonds are yielding 5.6%. The spread has been cut in half. Is it time to close out the trade?

We need to account for the fact that Magellan has started returning significant amounts of capital to shareholders via repurchases. The total number of units outstanding was down 5% year-over-year as of June 30th. A quick and easy way to adjust for this is to use their guidance of $1.09 billion of distributable cash flow for the year (which can be used for any combination of buybacks and dividends) that implies a shareholder yield of 10.3%. That is still 470 bps above the cost of debt - the spread has actually not tightened all that much.

Why hasn't it changed, even though the prices of the bond and units moved in directions that should have narrowed it? A key factor: an increase in the earnings per unit of Magellan. As we have emerged from the pandemic, earnings per unit for the trailing twelve months has risen from $4 (for last June) to $4.67 (this June).

This is nothing very profound; it is just why equities have historically outperformed bonds. Inflation is an incredible tailwind to equity investments with pricing power. You just have to avoid being wiped out by a deflationary crash. Is there going to be deflation? While Prechter may still think so, it is a political question. With Pelosi and her husband still daytrading, it is hard to imagine the elites tightening enough to cause a deflationary collapse. The Fed talks a lot about tightening but hasn't done much tightening.

We like ConvexityMaven's theory that the Fed is going to do yield curve control. Instead of letting the bond market crash and taking everything else with it, print money and buy bonds - keep the yields capped. But as the Maven says, in this scenario, "the other side of the balloon gets squishy" - meaning inflation.

If you look around the world, you will notice tons of countries with fiat currencies are running high inflation rates. Meanwhile, deflationary collapses are rare. Can you imagine the central banks of Brazil, Argentina, or Ghana tightening enough to cause a deflationary collapse? It has never happened, because the path of least resistance is inflation.

Betting on inflation is the cynical bet. But we have to be cynical enough to realize that the central bank doesn't want us hoarding real assets and is going to try to trick us with jawboning talk. People will believe the talk and there will be violent selloffs. This is why we like "first class" inflation protected assets and not leveraged junk.

If this theory of yield curve control is correct, holders of CD's or investment grade bonds may not lose too much more in nominal terms, since yields will be capped at some level. But they will lose a tremendous amount in real terms due to the inflation. And their loss will be the gain of equity investors in leveraged enterprises with pricing power, like Magellan.

2 comments:

Hydrocarbon royalties and pipelines are the new bonds.

Are the coupon payments on MMP bonds increasing?

The board of directors of Magellan Midstream Partners, L.P. (NYSE: MMP) has declared a quarterly cash distribution of $1.0475 per unit for the period July 1 through Sept. 30, 2022.

The third-quarter 2022 distribution is 1% higher than the $1.0375 paid for both second quarter 2022 and third quarter 2021.

The new distribution, which equates to $4.19 per unit on an annualized basis, will be paid Nov. 14 to unitholders of record at the close of business on Nov. 7.

https://finance.yahoo.com/news/magellan-midstream-increases-cash-distribution-130000237.html

Post a Comment