Lamar Advertising Company - Q1 2023 Earnings ($LAMR)

[Previously regarding Lamar Advertising.]

Lamar Advertising Company (LAMR) is one of the largest outdoor advertising companies in the United States based on number of displays (possibly the largest), and rents space for advertising on billboards, buses, shelters, benches, logo plates, and in airport terminals. They offer a fully integrated service, from ad copy production to placement and maintenance. They operate three types of outdoor advertising displays: billboards, logo signs, and transit advertising displays. However, 90% of their revenue is derived from billboards, with 65% from static billboards. The average billboard (static and digital) grossed $10,491 during 2021.

The market capitalization at $91.10 per share is $9.3 billion and the enterprise value is $13 billion. During the first quarter of 2023 (10-Q), the company reported free cash flow of $113 million, which was down 16% from the prior year quarter. The quarter's free cash flow yield on the enterprise value (FCF/EV) annualizes to 3.5%. Revenue for the quarter was $471 million, which was up 4% from the prior year. That gives a free cash flow conversion of 24%. Reported earnings were $76 million, which was down 17% from the prior year. That gives an annualized earnings yield of 3.3% on the current market cap.

The valuation is looking expensive because of the weak quarter. Some color from the conference call:

Categories of particular strength included services, amusements, entertainment and sports and restaurants. Real estate, predominantly local vertical, was relatively weak and insurance, which is primarily a national category, was also weak. Rate was up on both analog bulletins and posters while occupancy was slightly down. Our strongest regions were in the Atlantic and Gulf Coast and continue to trend that way. The Northeast, which is more reliant on national advertising, trailed our other regions.

Digging a little deeper into Q1 numbers, adjusted EBITDA was actually up 3.5% year-over-year. Something that hit free cash flow quite a bit was that interest went from $25 million the prior year to $39 million this most recent quarter. The other thing was that capital expenditures went from $29 million to $42 million.

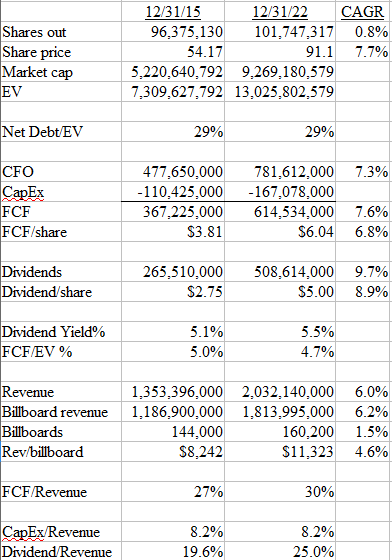

Last time we posted about LAMR, we did a comparison between 2015 and 2021. Let's update that with the 2022 full year results.

Lamar has been able to grow revenue per billboard by 4.6% compounded while also increasing the rate at 1.5% annually resulting in total revenue growing at 6% annually over the past seven years. They've done this while spending a constant ~8% or so of revenues on capital expenditures. (Compare with the 25% of total revenue paid to shareholders in 2022 as dividends, thanks to FCF/revenue conversion of 30%.) Lamar grows its billboard count partly through acquisitions, but shares outstanding have grown only at 0.8%. So the result is that FCF/share has grown at 6.8% compounded.

McDonald's franchisees are big advertisers, including on Lamar billboards. (We talked earlier this month about how McDonald's the franchisor has gotten quite expensive.) As we said in the first post on Lamar: most of the world's businesses are crappy. They have to advertise to remind people that they exist. It would not be too surprising if some of Lamar's customers spend a greater percentage of sales on marketing than their ultimate profit margins. Lamar is a beneficiary of that.

2 comments:

"As we moved into the third quarter, we observed a slowdown in business activity," Lamar chief executive Sean Reilly said. "Although we still feel positive about our efforts to control expenses, revenue for the second half of 2023 is not shaping up as we anticipated it would. As a result, we are revising our guidance for full-year diluted AFFO to a range of $7.13 to $7.28 per share."

https://finance.yahoo.com/news/lamar-advertising-company-announces-second-100000053.html

Lamar revenues for Q2 were up 4.4% and expenses were up 3.7% year-over-year. Big thing was that interest expense was up 48% y/y and is now 7.8% of revenue. Result was that net income was down 2.7%. Free cash flow was down 4.6%.

At $92 shares are now trading 18x income.

Not sure why they didn't term out their debt when rates were low? They left their SCF outstanding with a floating rate.

At December 31, 2021, Lamar Advertising Company’s wholly owned subsidiary, Lamar Media, had approximately $3.01 billion of total debt outstanding, net of deferred financing costs, consisting of approximately $764.4 million in bank debt outstanding under Lamar Media’s senior credit facility, $2.07 billion in various series of senior notes, $174.4 million under the Accounts Receivable Securitization Program and $2.4 million in other seller notes. [...]

The senior credit facility, as established by the Fourth Amended and Restated Credit Agreement (the “senior credit facility”), consists of (i) a $750.0 million senior secured revolving credit facility which will mature on February 6, 2025 (the “revolving credit facility”), (ii) a $600.0 million Term B loan facility (the “Term B loans”) which will mature on February 6, 2027, and (iii) an incremental facility (the “Incremental Facility”) pursuant to which Lamar Media may incur additional term loan tranches or increase its revolving credit facility subject to a pro forma secured debt ratio calculated as described under “Restrictions under Senior Credit Facility” of 4.50 to 1.00, as well as certain other conditions, including lender approval. Lamar Media borrowed all $600.0 million in Term B loans on February 6, 2020. The entire amount of the Term B loans will be payable at maturity.

The Term B loans bear interest at rates based on the Adjusted LIBO Rate (“Eurodollar term loans”) or the Adjusted Base Rate (“Base Rate term loans”), at Lamar Media’s option. Eurodollar term loans bear interest at a rate per annum equal to the Adjusted LIBO Rate plus 1.50%. Base Rate term loans bear interest at a rate per annum equal to the Adjusted Base Rate plus 0.50%. The revolving credit facility bears interest at rates based on the Adjusted LIBO Rate (“Eurodollar revolving loans”) or the Adjusted Base Rate (“Base Rate revolving loans”), at Lamar Media’s option. Eurodollar revolving loans bear interest at a rate per annum equal to the Adjusted LIBO Rate plus 1.50% (or the Adjusted LIBO Rate plus 1.25% at any time the Total Debt Ratio is less than or equal to 3.25 to 1). Base Rate revolving loans bear interest at a rate per annum equal to the Adjusted Base Rate plus 0.50% (or the Adjusted Base Rate plus 0.25% at any time the total debt ratio is less than or equal to 3.25 to 1). The guarantees, covenants, events of default and other terms of the senior credit facility apply to the Term B loans and revolving credit facility.

As of December 31, 2021, the aggregate balance outstanding under the senior credit facility was $775.0 million, consisting of $600.0 million in Term B loans aggregate principal balance and $175.0 million outstanding borrowings under our revolving credit facility. Lamar Media had approximately $562.6 million of unused capacity under the revolving credit facility.

https://www.sec.gov/Archives/edgar/data/1090425/000162828022003948/lamr-20211231.htm

Post a Comment