Sitio Royalties Corp. ($STR)

Sitio Royalties is a roll-up of royalty companies. They were initially private, created in 2016 by a PE firm called

Kimmeridge, which is still the largest shareholder (one of the Kimmeridge

partners is also the chairman of Sitio's board). They went public in January 2022 through a reverse merger with Falcon Minerals, and then changed their name to Sitio Royalties. In June they bought land from Foundation Minerals and Momentum Minerals and in December they acquired Brigham Minerals.

The market capitalization (at $25 per share) is $4 billion and the enterprise value is $4.8 billion. (Unusually for a royalty investment, Sitio has debt: $487 million on a revolving facility and $428 million of senior notes.) In the first quarter of 2023, Sitio earned $48 million and generated cash from operations of $129 million. That's an annualized CFO yield on the market cap of 13%. The dividend yield of STR is 8%; in line with the 65% of "discretionary cash flow" that they say they will pay as a dividend.

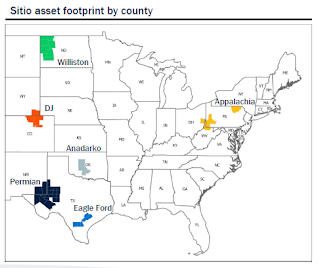

Sitio is geographically diversified across some of the major basins, but the bulk (70%) of their royalty acres are in the Permian. Their average daily production is 34k boe at about half oil. At Q1 commodity price levels, that means that oil revenue was 78% of total and natural gas was 10%, with the remainder NGLs and lease bonus revenue.

Something else different about Sitio is that they hedge some of their production. They presold 3,050 barrels of oil per day at $93.71 through the end of 2023. They sold 3,300 bbl/day at $82.66 for the year 2024. And they sold 1,100 bbl/day at $74.65 for the first half of 2025. They also have a collar (bought put at $60 and sold call at $93.20) on 2,000 barrels per day in the first half of 2025. That leaves a good bit of the 17,655 bbls/d of oil (at the Q1 production rate) unhedged.

In Q1 they produced 60,000 Mcf/d of gas. For the remainder of 2023, they have 8,500 Mcf/d collared at $4.82 (floor) and $7.93 (ceiling). In 2024, 11,400 Mcf/d collared at $4 and $7.24, and in the first half of 2025 11,600 Mcf/d collared between $3.31 and $10.34.

It will be interesting to watch how this aggressive management team maintains this hedge book, going forward.

This was a good discussion of the business model on the Q4 earnings call:

In 2023, we will also be acutely focused on gaining additional efficiencies and implementing new technologies to help us continue to scale and provide competitive advantages that will allow us to replace less effective third-party vendors. Professional management of oil and gas minerals is still a relatively new concept, and we believe there is a large opportunity to transform the industry, which currently uses many outdated methods and tools.

Technological advances geared specifically for the challenges of an independent mineral owner are in their very early stages of development, and we are piloting a number of new efficiency tools. We also see a large opportunity to fundamentally improve the relationship between operators and mineral owners while saving money and time on both sides and eliminating inefficiencies in the system from duplicative work done by hundreds of operators and tens of thousands of mineral owners.

So we're really excited about a couple of the initiatives we have starting this year. And we sit here in a pretty unique position where we view ourselves as the permanent owners of these assets. And we're buying assets and people who maybe aren't necessarily the permanent owners, and that's why they're selling them to us.

And as the permanent owners, we're going to manage them differently, meaning we're going to make sure we're getting paid timely on every well, every month. Making sure that the decimals on which we're paid matched the decimals on which we believe we own. And we track these things monthly. We prioritize the missing payments that we believe we're owed, and we pursue them with operators.

And to do that, a business of our scale with 5,000 leases, over 25,000 wells, it takes a lot of technology and data management to do it efficiently. And so we are developing tools on our own just because there are -- there's no suite of software that effectively manages a minerals business. So we've spent a lot of time in 2020 building out our data warehouse and data management system, and that has allowed us to scale up the way that we have.

And now we're working on ways to make our team more efficient by having them touch fewer of the data points and just automatically process some of the data points. So things like revenue or division orders are just begging for efficiency measures. So we're working on those things this year.

Also on the Q4 call:

At the end of December, we made our first quarterly amortization payment at par of $11.25 million on our senior unsecured notes, reducing the outstanding principal from $450 million to $438.75 million. The senior unsecured notes prohibit us from making stock repurchases, which we would like to be able to opportunistically do with the 35% of our discretionary cash flow that we don't distribute as a quarterly dividend.

We are monitoring market conditions for an opportunity to refinance these notes either after the first call date on September 21 of this year, or sooner, if warranted, to provide our company the appropriate amount of capital allocation flexibility. Regarding our outlook for additional large-scale acquisitions, we remain focused on our underwriting discipline and believe that there will be fewer opportunities that meet our returns criteria in 2023 compared to 2022.

There is still a large opportunity set of high quality and sizable minerals positions to consolidate, and we have made several offers to acquire additional mineral assets this year, but the bid-ask spread has been too wide. If attractive consolidation opportunities do not materialize, we will continue to focus on strengthening the balance sheet by paying down our prepayable debt and building liquidity for when market conditions normalize.

In the first quarter earnings announcement, they mentioned:

Producer activity on our assets continues to be steady, with average production of 34,440 Boe/d in the first quarter, which is in-line with Sitio’s pro forma production of 34,424 Boe/d in the fourth quarter of 2022. We evaluated approximately 50,000 net royalty acres for acquisition in the first quarter of 2023, but we did not find any opportunities that met our returns criteria. This was the first quarter in over two years that we haven't announced or closed an acquisition. Instead, we focused on strengthening the balance sheet by reducing long-term debt by approximately $34 million and continuing to improve our internal efficiencies.

The Dorchester model is: no debt, no hedges, low overhead. In Q1 2023, Dorchester spent $2.7 million on G&A cost, plus $0.76k allocated to the general partner, which amounted to about 9% of total revenue.

Meanwhile, Sitio spent $11.7 million on G&A which was 8% of total revenue. They also spent $22 million on interest expense (their debt is pretty high coupon) and had a $15 million benefit from their commodity hedges.

It will be interesting to see which one performs best. Dorchester seems safe and steady but it may work to put some capital with the aggressive gunslingers of Sitio. It is encouraging that they are talking about building out software and management tools to manage their properties and make sure that they are not being shortchanged by the operators. We do not see any other royalty companies talking about this, and it is an especially big problem at the royalty trusts, which are frankly under-managed.

Sitio has a scale advantage ($4.8 billion EV versus $1.1 billion for Dorchester and only $125 million for Cross Timbers) that will allow them to invest more in this area.

No comments:

Post a Comment