The Shale Treadmill

We have been baffled by shale producers for over a decade, as they have claimed miraculous well productivity while at the same time needing to continually raise capital, with unpleasant results for both equity and debt investors.

We once wrote about a small E&P in the Midland Basin of the Permian called Approach Resources, which had 110,000 net acres. They happened to be leveraged with expensive debt (term loan and 7% senior notes) so their finances kept getting more strained. They became an interesting test case of what happens to a high decline rate (shale) producer when it stops drilling wells.

In the first quarter of 2017 their capital expenditures were $13 million (for three horizontal wells) compared with $5 million in Q1 2016. But their production in BOEs that quarter was down 12% year-over-year and their oil production was down 22%.

In the first half of 2019, Approach hit the wall and were forced to slash their capital expenditure to only $1.7 million. Their total production of oil and gas then fell 17% year over year during the second quarter of 2019.

They had been drilling uneconomic wells and slowly built up an unpayable debt load. They went bankrupt in November 2019.

Going over the E&P results for the first quarter of 2023 gives us an eerie feeling of repeating the experience with the shale companies (like GMX Resources or Goodrich Petroleum) over the past decade. The producers' results were horrible. Not just because the commodity price is lower than last year, which obviously hurts,

but because of very large increases in capital expenditure coupled with much

smaller increases in production, or even declines.

We had gotten interested in Occidental Petroleum because Buffett has been buying and has taken his stake up to one-quarter of the company. And, of course, Oxy's focus is in the Permian which is where Texas Pacific Land owns 900,000 acres outright, and which is the only shale basin in the U.S. where production has not yet peaked.

Oxy gives really good disclosures of capital expenditure and production for each basin in its earnings release. We notice that in the Permian, which is their most important basin, capex was up 75% year-over-year with BOEs produced up only 23% and actual barrels of oil up only 20%.

Then, on the Q1 conference call, Oxy talked about how they drilled the longest DJ Basin well ever (25k ft), set a lateral length record (18k ft), and set a record for continuous pumping time (28 hours vs 22.5) in the Delaware in the Permian. Are we supposed to be excited that oil wells now require five miles of steel pipe when a century ago you just had to poke a hole in the ground to get a gusher?

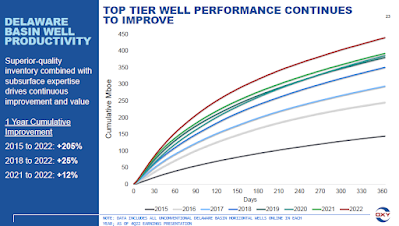

On slide 23 of their investor presentation, Oxy says "top tier well performance continues to improve." They show the "cumulative" (really, one-year) recovery (in BOE) for wells drilled in the Delaware Basin, with the total increasing 12% per well y/y and 205% per well since 2015.

However, there is no mention in this slide of the length of the wells (which we know has risen) or the cost of drilling them (which surely must have risen also).

We looked at some past presentations and earnings releases by Oxy, and while the company does not disclose this metric, from what we can tell if you normalize their "cumulative BOE" metric for each year by that year's average lateral length, it has not really improved at all but remained constant at around 0.1 boe/d/foot. And that does not account for the fact that the gas/oil ratio in the Permian is rising, so the value of one BOE is actually falling over time, which would mean the well economics are getting worse.

In our experience it is a bad sign when companies tout a metric that sounds impressive but is not economically meaningful or is misleading. We went through this with GMX Resources in the Bakken, which touted misleading initial production figures as it drilled uneconomic wells and burned through its investors' capital.

We are surprised that no one else seems to be talking about this or asking about it on the conference calls. But then we found a paper called "The paradox of increasing initial oil production but faster decline rates in fracking the Bakken Shale." The author says these longer laterals and bigger fracks are shifting production forward but not increasing the ultimate recovery [link]:

The increase in the length of horizontal wells over the study period (Fig. 1a) shows the average well in 2007 was 5000 ft in length, jumping to ~9000 in 2008, and has increased very slowly through 2018 to ~10,000 feet. The relative fracture intensity can be estimated by the volume of fluid injected per length of lateral. This metric shows an exponential increase from 2012 through 2017.

The 12-month cumulative oil production (a metric favored by operators), shows an accelerating increase with time from 2006 through Q1 2018 (Fig. 2a) with a more regular pattern of increasing rate from 2012 to 2018 (and a dramatic increase of approximately 50% from 2015 to 2018). Normalizing these values to the length of laterals lessens the rate of increase. [...]

Over the last decade, tight oil operators in the Bakken play have dramatically increased initial production from their wells. This has been widely interpreted as reflecting an equivalent increase in the EUR of these wells. These increases in 12-month cumulative-production correlate with the increased fracture-water intensity in Fig. 1b and, at face value, appear to support the operator's apparent belief that their application of improved technology is increasing the ultimate oil recovery from these wells. However, our analysis shows that due to faster terminal decline rates the ultimate recoveries decreased from 2010 to 2017 [...]

Recall that the Smith (2018) model for ultimate recovery from the Bakken play has a built-in increase in “fracking efficiency” of 15% per year. Smith suggested that this increase was “roughly consistent” with the Covert (2013) “estimate of efficiency gains” as a result of operators learning how to optimize strategies for proppant and fluid intensities. Smith assumed that “fracking efficiency” increased during this time period at an even higher rate. Apparently, he based this on the idea that many of these wells were being drilled in reservoir rocks of lower quality. He concluded that these wells “are understood to have achieved higher IP rates” than expected. These higher rates he saw, not as the result of higher quality reservoirs or presumably higher oil saturations, but rather because “they benefited from the cumulative effect of rapid learning.” By this, Smith meant that companies learn from one another about how to increase IP of wells (efficiency gains in Smith's parlance) by finding optimal weights of proppant and volumes of fracking fluid to inject. On this basis he estimated that efficiency was increasing about 20% annually.

One measure of the intensity of hydraulic fracturing is the volume of fracture fluid pumped per length has increased over time (from 2008 to 2017). This corresponds with the median time to BDF decreasing, consistent with faster drainage of oil from the fractured volume. Over the same time period the decline rate (TDR) increased. This decrease was so large that it has triggered numerous articles in oil and gas industry magazines, as noted in the Introduction. What has not been recognized prior to this study is that the increase in decline rate that is positively correlated with higher IP measured by the 12-month cumulative production.

In his recent study, Smith (2018) assumed that wells drilling in the future would have a constant ratio of EUR to IP. Smith (2018) did suggest, “a potential negative correlation between IP and the subsequent decline rate” is a factor that “cannot be ruled out.” Despite this qualifier, Smith used the assumption of constant EUR:IP ratio in his projections of future production from the Bakken. Smith viewed the increase in “fracking efficiency” is likely to continue to increase and to “raise the volumes of … oil that operators are able to extract from the remaining sites.” [...]

According to our analysis, the very strategies that operators have pursued in order to increase initial production (larger completions, more hydrofracture stages) have also resulted in accelerating boundary-dominated flow and increasing terminal decline rates. Therefore, increases in IP can be achieved by increased fracturing intensity with minimal change in the length-normalized EUR. This explains the apparent paradox outlined in the Introduction. Our analysis is clearly inconsistent with the ideas presented by Covert (2013) and the conclusions of Smith (2018). The data and analysis presented in this paper is inconsistent with Smith's assumption that ratio of EUR to IP is constant. [...]

Male et al (2018) found evidence that declining EURs are a product of wells being drilled in areas with higher water cuts over time. As low water saturation rock is exhausted, operators appear to have been forced to complete wells in rock with higher water saturation. These reservoirs with high water saturation rock are more difficult to produce from.

Most previous analyses of oil production decline-curves for Bakken wells have used 12-month cumulative production as a proxy for EUR. This approach is likely to generate significantly erroneous results because it does not take into account the changing long-term decline rates. [...]

The contribution that tight oil will make to future US oil production is a controversial subject, with vigorous arguments being made by proponents of two views. This study has demonstrated that the assertions of both sides of the argument are inconsistent with rigorous, physics-based analysis of the well production data. Over the last 16 years, the initial production of Bakken wells has increased, as reported by industry and modeled by Covert (2013) and Smith (2018). The increase in early production has resulted from operators increasing the fracture intensity of completions. This is consistent with the assertions of operators in the Bakken play. At the same time as the median initial production of Bakken wells increased (by as much as 100% from 2014 to 2018), their estimated ultimate production (EUR) remained broadly constant. [...]

Using metrics such as the 12-month cumulative oil production (favored by operators) as an analogue for EURs, as has been done in most machine learning analyses of tight oil productivity, results in erroneous results. Overestimates of long-term productivity for recently drilled wells of 50–100% are likely when EUR estimates are based on IP.

Over the last 10 years, the average EUR for new Bakken wells has remained largely constant and actually decreased from 2010 to 2017. The average, length-normalized EUR decreased from 2009 to 2015. These trends correlate with a general increase in the water to oil ratio that is best interpreted as a decrease in the average reservoir quality. [...]

The results of the current study resolve the apparent discrepancy between (a) operator's claims of large increases in well productivities and (b) analysts claiming that long-term production of these same wells may be significantly lower than expected. For the Bakken, implementation of more closely spaced, intensive fracturing results in higher initial production and steeper terminal-production declines. Critics focus on the higher terminal-decline rates whereas operators trumpet the higher initial production. These are not mutually exclusive, but their analyses do not incorporate an understanding of the nature of production from multi-stage fractured horizontal wells as expounded here. The overarching conclusion that arises from this study is that the advances in completion technologies, which are in widespread usage, are not increasing the EURs of tight-oil wells. This conclusion is important in the context of estimating the total reserves for tight oil plays and thus for predicting future US oil production. Published estimates that optimization of completion strategies has resulted in 10–20% increases in the lifetime productivity of multi-stage fractured wells are not supported by the analysis of the large production data-base presented in this paper.

We also saw this in the Journal of Petroleum Technology [link]:

Longer laterals can significantly cut costs, but are those added feet also productive? Rystad forecast—based on the distribution of expected completion activity by county, landing zone, and well design—that the average productivity of new Permian wells seems to track the well length. Between 2019 and 2022, the average well output was up from about 850 to 1,000 BOE/D, and the average lateral length rose from 8,500 to 10,000 ft. When the Norwegian data and consulting firm compared the results of companies doing 2- and 3-mile-long laterals in comparable rock with similar completions, they found the production per foot for longer laterals sometimes falls short. “Our conclusion so far was that many of them were able to maintain productivity per foot, but we also recorded some cases with 10 to 20% degradation in productivity per foot for 3-mile laterals”

The author of the "paradox" paper mentions rising water cuts as a warning sign of a depleting field. We are seeing a rising gas/oil ratio and rising water cuts even in the Permian, which is the only shale basin in the U.S. that has not peaked. Note that the rising gas oil/ratio means that a BOE today is worth less than a BOE five years ago. If the productivity (in BOEs) per foot of lateral length is only holding constant, it would mean that the well economics are getting worse.

Shubham Garg (good guy to follow for Canadian energy) is noticing what's happening too. The chart that he posted (below) shows the production per foot of lateral for wells in two counties of the Permian over the past six years. He describes this year as having an "almost comedic well productivity degradation."

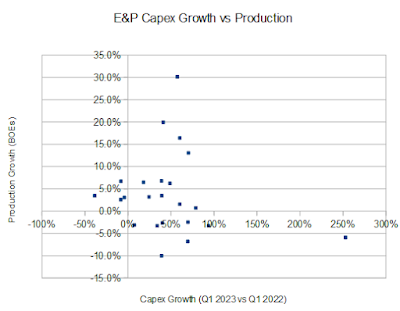

The change in capital expenditure compared with change in production was a red flag for Occidental Petroleum. How does this metric look if we examine the other, largest oil producers in North America (from the XOP and XLE)?

Let's call it a "production shortfall" when the production growth is less than the capex growth. The worst production shortfalls in Q1 were the shale producers, particularly the smallest companies. (Occidental is by no means the worst.)The best performers, with the smallest production shortfalls, were those with the most front-loaded costs and conventional, slower-declining production: offshore and to a somewhat lesser extent (less than we might have thought) the Canadian oil sands. There were several companies that were able to grow production by more than their capex increase. There were also four companies that grew production even with a decrease in capex year-over-year.

One of those dots on the scatter plot belongs to PDC Energy (PDCE). In Q1, capex was up 94% year-over-year and total production was down 3.3% with oil production down 6%. The valuation, a FCF/EV yield of 13% based on Q1 results, is expensive. For some reason, Chevron is acquiring them.

The worst dot (far right bottom corner) grew capex 250% and had total production fall 6%. Overall, looking at the top 17 companies in the XOP index (mostly shale producers), they grew capex in aggregate 39% and their BOE production grew only 4%.

The shale companies are spinning the treadmill harder and harder to stay in the same place, and the winners at the end of the day are going to be the royalty owners. The number one operator on Texas Pacific land is... Oxy. (Texas Pacific is not "cheap" at 6% FCF/EV, however that was at $75 oil and $3.60 gas.)

From a royalty owner's perspective, oil and gas executives are people who get to live in nice houses in Houston in exchange for bringing their investors' money to you.

.png)

4 comments:

Awesome work. Thank you for the education!

Joel

Thank you for this awesome work!

I suspect that you have read the work of Scott LaPierre as he has also produced excellent work on the shale data:

https://www.linkedin.com/pulse/wall-street-journal-validates-predictions-made-scott-lapierre/

Your conclusion rhymes with Gorozen's Q1 2023 report titled "Hubbert’s Peak is here" that just came out yesterday.

Great minds like yours think alike:

Hi xxxxx,

Hubbert’s Peak is here. The only source of growth over the past decade, the shales, are now beginning to show signs of exhaustion.

In 2019 we detailed our neural network and explained why the Permian Basin would peak later in the decade. In retrospect, we were too conservative.

Productivity in the Permian fell last year for the first time in history.

Our newest commentary, Hubbert’s Peak is Here, looks at what is driving lower productivity in the shales, and why recent trends could predict field exhaustion across the shales.

Download our Q1 2023 commentary for insight into:

Why the Permian may peak later this year

Why we remain bullish on natural gas

Trends that could spell the end of the US dollar as a global reserve currency

Where commodity markets go from here

Access our Q1 2023 market commentary here.

We appreciate your interest and continued support.

Sincerely,

Adam

Adam A. Rozencwajg, CFA | Managing Partner

Goehring & Rozencwajg Associates

https://info.gorozen.com/2023-q1-hubberts-peak-is-here?utm_campaign=2023 1Q Commentary&utm_medium=email&_hsenc=p2ANqtz--8JnEfGZLcVJt-SoEiqWl_z4eywEaC_cTLojUGEYWVqwsBqCGGDg1q9PlygNEhYnKAIlI5iuztlsjkmsfhenruMlnXkA&utm_source=hs_email&utm_content=260911166&hsCtaTracking=8a7e470f-0438-4f2f-8b71-b33f83589fe2|68ef535b-ae40-4a22-b051-88c372bbdd32

Thanks Joel!

Post a Comment